When it comes to building wealth, two approaches stand out: long-term investing and short-term trading. They might both involve putting money into the markets, but the way they work—and the type of mindset they require is different.

Choosing the right approach depends not just on your personality, but also on your goals, risk tolerance, time commitment, and even your stage of life. Here’s a practical guide to help you understand both approaches, see difference between trading and investing and decide which approach might fit you best.

What Is Long-Term Investing?

Long-term investing means buying and holding assets like stocks, bonds, index funds, or real estate over a period of years—or even decades. The objective isn’t to react to every news headline or price swing but to stay focused on bigger trends that unfold over time. This approach relies on the power of compounding, where your earnings generate additional earnings, creating a snowball effect that accelerates as time passes.

Patience here is key. The market can be unpredictable in the short term, but historically it has rewarded those who stay invested.

What Is Short-Term Trading?

In contrast, short-term trading focuses on making profits from short-term movements in asset prices. Traders might hold positions for weeks, days, or even minutes (in Day Trading), attempting to capitalize on volatility rather than underlying long-term value.

Short-term trading demands constant attention and rapid decision-making. Traders analyze technical indicators, market trends, news events, and sometimes even social media chatter to predict where prices might move next. It’s a high-risk, high-reward activity that resembles more of a specialized skill—or even a job—than a passive investing strategy.

Statistically, it’s challenging to succeed as a short-term trader. A major study by the National Bureau of Economic Research found that only about 1% of individual day traders consistently make profits over time. This underlines how difficult it is to beat the market through quick moves and timing strategies, even with sophisticated tools.

Additionally, short-term profits are taxed as regular income, which can significantly cut into returns. Add to that the high transaction costs from frequent buying and selling, and it’s clear that short-term trading carries heavy hurdles for the average investor.

Key Differences at a Glance

To better understand how these approaches differ, here’s a simple comparison:

| Long-Term Investing | Short-Term Trading | |

|---|---|---|

| Time Horizon | 5+ years, often decades | Seconds to a few months |

| Primary Focus | Wealth accumulation through compounding | Profit from short-term price changes |

| Risk Profile | Lower short-term volatility concerns | High daily or weekly volatility |

| Tax Treatment | Favorable long-term capital gains rates | Higher short-term ordinary income tax rates |

| Time Commitment | Minimal—quarterly or yearly check-ins | High—daily or hourly attention needed |

| Success Rate | Higher among disciplined investors | Very low (1% achieve consistent success) |

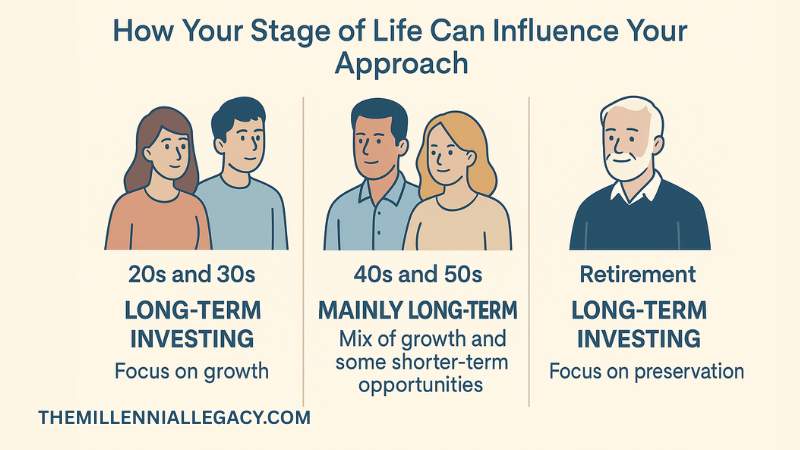

How Your Stage of Life Can Influence Your Approach

While strategy ultimately depends on personal goals and temperament, your age and financial stage play a natural role in determining which approach makes the most sense.

In your 20s and early 30s, you generally have decades ahead before needing to access retirement savings. This longer time horizon allows younger investors to withstand short-term market dips and benefit fully from compounding. As a result, long-term investing heavily in diversified assets like index funds or ETFs typically makes the most sense at this stage.

Mid-career investors, typically in their 40s and 50s, start facing more competing financial priorities: mortgages, children’s education costs, and retirement planning. Here, the core strategy often remains long-term investing, but some may allocate a small portion of their portfolios to short-term opportunities if they have both the time and risk appetite.

For retirees or those nearing retirement, preserving wealth becomes more critical than aggressive growth. At this stage, short-term trading is usually less suitable due to the risk of sudden large losses. Instead, a conservative long-term investment approach with a focus on income-generating assets like dividend stocks and bonds tends to dominate.

Pros and Cons of Each Strategy

Understanding the advantages and disadvantages of both paths can help you align your strategy with your personal goals:

| Pros | Cons | |

|---|---|---|

| Long-Term Investing | Benefits from compounding Lower taxes Less stressful Proven historical returns |

Requires patience Emotionally tough during market downturns Slower gratification |

| Short-Term Trading | Potential for fast profits Active control over investments Opportunity to capitalize on volatility |

High risk of loss Time-consuming High taxes and fees Requires advanced skill and discipline |

Why Most People Benefit More from Long-Term Investing

Long-term investing, statistically and historically, is a more reliable way for most individuals to grow wealth.

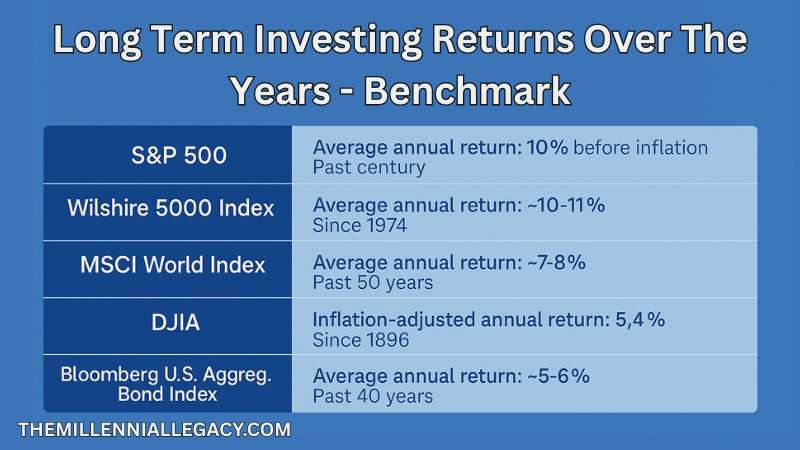

According to MoneyRants, the S&P 500 has delivered an average annual return of about 10% before inflation over the past century. Even adjusted for inflation, the real return sits around 7% per year. And the S&P 500 isn’t the only example: the broader U.S. stock market, as tracked by the Wilshire 5000 Index, has also produced long-term average annual returns of around 10–11% since its launch in 1974 (source). Global equities, measured by the MSCI World Index, have delivered average returns of approximately 7–8% over the past 50 years (source). Even the more concentrated Dow Jones Industrial Average (DJIA), which tracks 30 major U.S. companies, has posted inflation-adjusted returns of about 5.4% annually since its creation in 1896 (source).

For more conservative investors, bonds have shown steady resilience as well. The Bloomberg U.S. Aggregate Bond Index—a broad benchmark for U.S. bonds—has delivered average annual returns of about 5–6% over the past 40 years (source).

This consistent historical performance across different asset classes highlights why so many investors prioritize steady, disciplined growth over chasing short-term market moves, even during periods of economic turmoil or uncertainty.

Let’s look at this from another angle: a research from J.P. Morgan shows that investors who stayed fully invested in the S&P 500 between 2002 and 2022 achieved an annualized return of 9.76%, but if they missed just the 10 best days in that 20-year span, their return dropped to only 5.33% (source). The takeaway here is clear: trying to time the market often backfires, and missing just a few key growth days can devastate long-term returns. Time in the market, not timing the market, wins almost every time.

When Short-Term Trading Might Make Sense

Although long-term investing tends to be the best fit for the majority of people, there are situations where short-term trading can play a role—or even be the right focus for certain individuals.

Short-term trading may be more appropriate if you meet several of these conditions:

- You have the time and willingness to commit significant daily attention.

Trading isn’t passive. Successful traders treat it like a job, not a hobby. - You have a high tolerance for risk and can handle emotional swings.

Quick losses—even large ones—must not derail your discipline. - You have a clear trading system or strategy and stick to it.

Random, gut-feeling trades usually lose money over time. - You understand technical analysis and short-term market movements.

Traders often rely on charts, momentum indicators, and market psychology—not just fundamentals. - You can afford to lose the money you are trading with.

Experts often recommend that only a small portion of your total net worth be used for short-term trading.

Some individuals use short-term trading for specific goals, such as supplementing income, managing risk in volatile markets, or taking advantage of opportunities during extreme events. However, even for skilled traders, success is often uneven and highly dependent on discipline, experience, and adaptability.

If you recognize these traits in yourself—and are willing to treat trading like a structured financial activity rather than entertainment—it may have a place in your broader financial strategy.

But for most people, trading remains high-risk and should only be approached with caution.

There’s a reason investing advice often sounds like a blend of numbers and psychology. It’s because whether you’re investing for the long haul or trading for tomorrow’s opportunity, success almost always comes down to knowing yourself better than you know the market.

The truth is, both strategies—investing and trading—exist because people are wired differently. Some crave the quiet accumulation of decades; others are drawn to the adrenaline of quick decisions. Neither path is “better.” They’re simply different ways of answering the same question:

How do I turn today’s money into tomorrow’s possibility?