Ah, millennials—the generation that witnessed the rise of the internet, made avocado toast a cultural staple, and, apparently, pioneered a new way to take a vacation. Gone are the days when a “vacation” meant packing your bags, booking flights, and getting away from work for a week or two. Now, we have “quiet vacationing,” the latest trend among millennials who want the relaxation of a holiday without having to deal with the actual “vacation” part. It’s work, but not as we know it—and it’s changing the way we think about time off.

But before you start picturing millennials lounging on a beach with a laptop, trying to write that email while sipping a coconut drink, let’s break down what quiet vacationing really is, why millennials are into it, and whether or not it’s a sustainable trend.

Quiet Vacationing: Not Just for Millennials

Now, while millennials may have been the pioneers of this trend, the practice of quiet vacationing isn’t limited to them. It’s actually a growing movement that spans several generations, especially as remote work and flexible schedules have become more mainstream. Workers across age groups are increasingly choosing to blend vacation time with work time, seeking peace and relaxation without fully disconnecting from their professional responsibilities.

Quiet vacationing is essentially when workers take a break from the usual grind but still manage to handle some work duties in a more relaxed, remote setting. This could mean booking a serene retreat, a cozy cabin, or a secluded beach destination where you can work on your laptop for a few hours, but the rest of the time is spent recharging. It’s a flexible, hybrid approach to time off that lets you enjoy a vacation-like atmosphere without fully stepping away from work.

As Generation Z, Generation X, and even Baby Boomers adopt remote work practices, the trend of quiet vacationing has become more accessible to a wider group of people. These workers no longer need to fully disconnect from their jobs to get some time away; they can blend work and relaxation into one seamless experience.

However, millennials have embraced this trend more than most, and here’s why it’s closely associated with them.

Why Quiet Vacationing is Closely Associated with Millennials

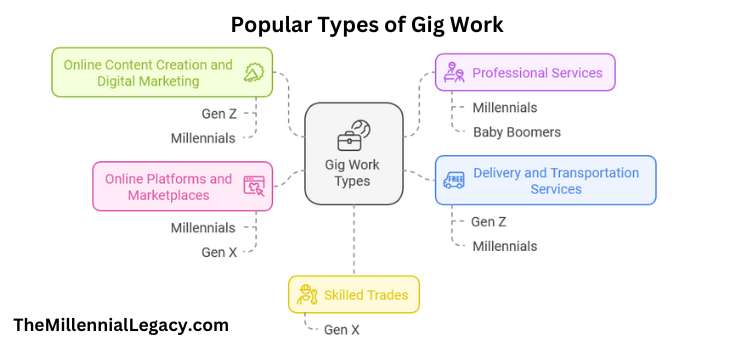

Remote Work Culture: Millennials were among the first to champion remote work. They came of age during the rise of the internet and digital tools that made it easier to work from anywhere. While younger generations like Gen Z are also tech-savvy and drawn to this lifestyle, millennials were the ones who first pushed for flexible work arrangements, freelancing, the gig economy and side hustles. After the pandemic shifted many work environments to remote, millennials were quick to incorporate quiet vacationing into their lifestyle, blending the need for rest with their drive for productivity.

Work-Life Balance: Millennials are known for valuing a healthy work-life balance more than previous generations. For them, work isn’t just about earning a paycheck; it’s about integrating personal fulfillment and well-being. Quiet vacationing allows millennials to combine the best of both worlds: they can unwind in a peaceful destination, practice self-care, and still get some work done, all without feeling the pressure of traditional office hours or the anxiety of asking for time off.

Reluctance to Ask for PTO: Millennials often feel uncomfortable requesting paid time off (PTO). Why? It’s a generational thing—many millennials grew up during the 2008 financial crisis, when job security was a big concern, and the pressure to constantly hustle was ingrained in their professional identity. In a world where they already juggle work, side projects, and personal commitments, the idea of taking time off can feel like a risk. Quiet vacationing offers a workaround: they get the time away they need without explicitly asking for time off, avoiding any potential negative perceptions about their work ethic.

Digital Connectivity: The internet revolutionized work for millennials. They are the first generation to truly embrace the gig economy, remote work, and freelancing, where digital tools allow for flexibility and constant connectivity. This makes it easier for them to hop on a video call or shoot off an email while lounging on the beach or hiking in the mountains. For millennials, working remotely from a peaceful retreat is an ideal way to stay productive while still carving out time for personal enjoyment.

Why Other Generations Are Joining the Trend

While millennials may have spearheaded the quiet vacationing movement, it’s not just them who are benefiting from it. Gen Z, Gen X, and even Baby Boomers are starting to embrace the idea of blending work and relaxation as remote work becomes more accessible.

Generation Z: The younger generation has grown up with technology and social media, and they’re more comfortable with the idea of working remotely. Many Gen Z workers are already freelancing or working from home, so the idea of combining work with a vacation is appealing to them as well. They may take this trend even further by spending their time traveling while still earning an income.

Generation X: For Gen X, the appeal of quiet vacationing often lies in their growing desire for work-life balance as they juggle the pressures of mid-career responsibilities and family life. Many Gen Xers are in leadership roles where they have more control over their work schedules, making it easier for them to take remote vacations without the need for formal PTO requests.

Baby Boomers: While less likely to adopt quiet vacationing at the same rate as younger generations, some Baby Boomers are still finding ways to work remotely or enjoy flexible retirement schedules. As they transition into semi-retirement, many are discovering the benefits of a slower-paced lifestyle and may use quiet vacationing as a way to recharge while still handling light work duties.

The Employer’s Perspective on Quiet Vacationing

From an employer’s standpoint, quiet vacationing can be a double-edged sword. Some employers embrace the flexibility of remote work and recognize that allowing workers to blend productivity with rest can boost morale. This flexibility can lead to higher job satisfaction, lower stress, and ultimately better performance.

However, not all employers are comfortable with the lack of transparency. Accountability can become a concern, as employers may be unsure how much work is actually being done when employees are away. Additionally, some employers worry that work-life boundaries could blur, leading to burnout if employees don’t truly disconnect.

Are Employers Always Aware?

Employers aren’t always aware of when an employee is quietly vacationing. Many workers are discreet about blending work and leisure, responding to emails or attending meetings while away. However, as remote work becomes more common, employers may start to notice patterns and questions may arise. Some companies are already embracing more transparent policies, offering flexibility while ensuring that employees are upfront about their schedules.

Is Quiet Vacationing Sustainable?

You may be wondering: Is quiet vacationing sustainable in the long run? After all, it’s easy to imagine working remotely from a tropical destination for a week or two, but can it be a viable long-term solution?

Experts have mixed opinions on this. On one hand, quiet vacationing allows workers to maintain productivity while taking time for themselves. It’s especially beneficial for people who crave balance and don’t want to be tied to a rigid work schedule. However, it’s important to be cautious about slipping into the trap of never fully unplugging. The whole point of a vacation is to recharge, and if you’re constantly checking emails or hopping onto Zoom calls, you might not be getting the rest you need.

To make quiet vacationing sustainable, experts recommend setting clear boundaries. Work for a couple of hours in the morning, take your meetings, and then spend the rest of the day enjoying the tranquility of your surroundings. Don’t let your vacation become just another extension of your workday.

Should You Try Quiet Vacationing?

If you’re a remote worker—or just someone with a flexible job—quiet vacationing might be the perfect way to take a break without falling behind on your responsibilities. It’s a chance to enjoy a change of scenery, decompress, and still manage your work duties without the pressure of taking time off.

However, if you do decide to give quiet vacationing a try, transparency with your employer is key. Be open about your plans and establish clear expectations with your boss about your availability and work commitments. Clear communication ensures that you’re on the same page, avoiding potential misunderstandings about your productivity or availability during your time away.

Whether you’re a millennial embracing the trend or someone from another generation looking to work while you unwind, quiet vacationing is here to stay. It’s about finding that perfect balance between work and relaxation, so long as everyone involved is informed and aligned on expectations.